Additional Companies and Services

Whatever request you may task us with, we will take care!

Tax, business and legal advice:

Tax advice to tax residents and non-residents.

Specialized in international tax law, double tax treaty, imputation/exemption method, third-country issues.

Advice on tax optimization.

Guidance on mandatory tax returns in Spain and compliance.

Property tax, Informative statement of assets and rights located abroad – form 720.

Exit tax – with the collaboration of foreign tax advisors.

Binding requests before the Spanish Tax Administration, representation of your

interests before the Tax Administration, enforcement of your rights.

Coordination with foreign tax advisors, lawyers, notaries public and other service providers, in German and English language.

Application for Spanish tax numbers (NIE), translations, obtaining of digital signatures/certificates, registry for tax purposes etc.

Tax returns to be submitted by non-resident persons:

Form 720 – Assets abroad

Form 714 – Property tax

Form 210 – Non-residents, private use of vacation property, rental income, profits derived from real estate transfer.

Form 211 – Withholdings from property acquisition by non-residents.

Form 347 – Informative statement of transactions with third parties.

Form 650 – Inheritance tax

Form 651 – Gift tax

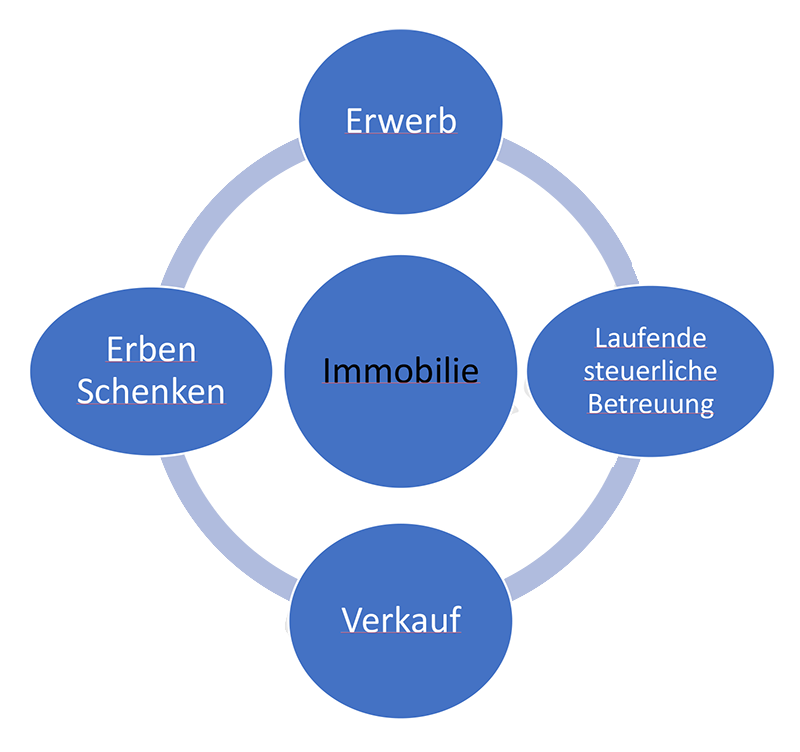

Real estates: We will give you advice on your investment decision, assisting you with all

types of tax, business and legal matters during the property’s whole lifecycle phases,

whether vacation or rented property, wherever in Spain, in Spanish language and,

alternatively, also in German or English.

Barcelona

Riera Principal 8, 08328 Alella, Barcelona

Madrid

C/Goya, 15 – 6º planta, 28001 Madrid

Read more about GDPR compliance

Responsible party: ETL Steuerberatung Spain

Purpose: Collection of personal data to meet your request

Legitimation: Consent of the interested party

Recipients: No data will be transferred to third parties, except legal obligation

Rights: Access, rectify or delete the data, as well as other rights, as explained in the additional information.

© 2023 ETL Steuerberatung Spanien | Terms and conditions of use | Privacy Policy | Cookies policy | Web development ETL Digital